ISAs

ISAs

20

February, 2020

ISAs

Tax Year

Cash ISA

Stocks and Shares

It seems fair to suggest that everyone would like to put aside a bit of extra money when they can, and an ISA could be a smart way to do so. With the extra positive that they come with tax free interest, ISAs can be an efficient way of making your money work for you.

So, what is an ISA?

ISA stands for Individual Savings Account – it’s a tax efficient way of investing or saving your hard-earned money. Unlike a savings account where your savings are only tax free up to a certain point, an ISA is consistent in keeping any interest you make on your savings tax free.

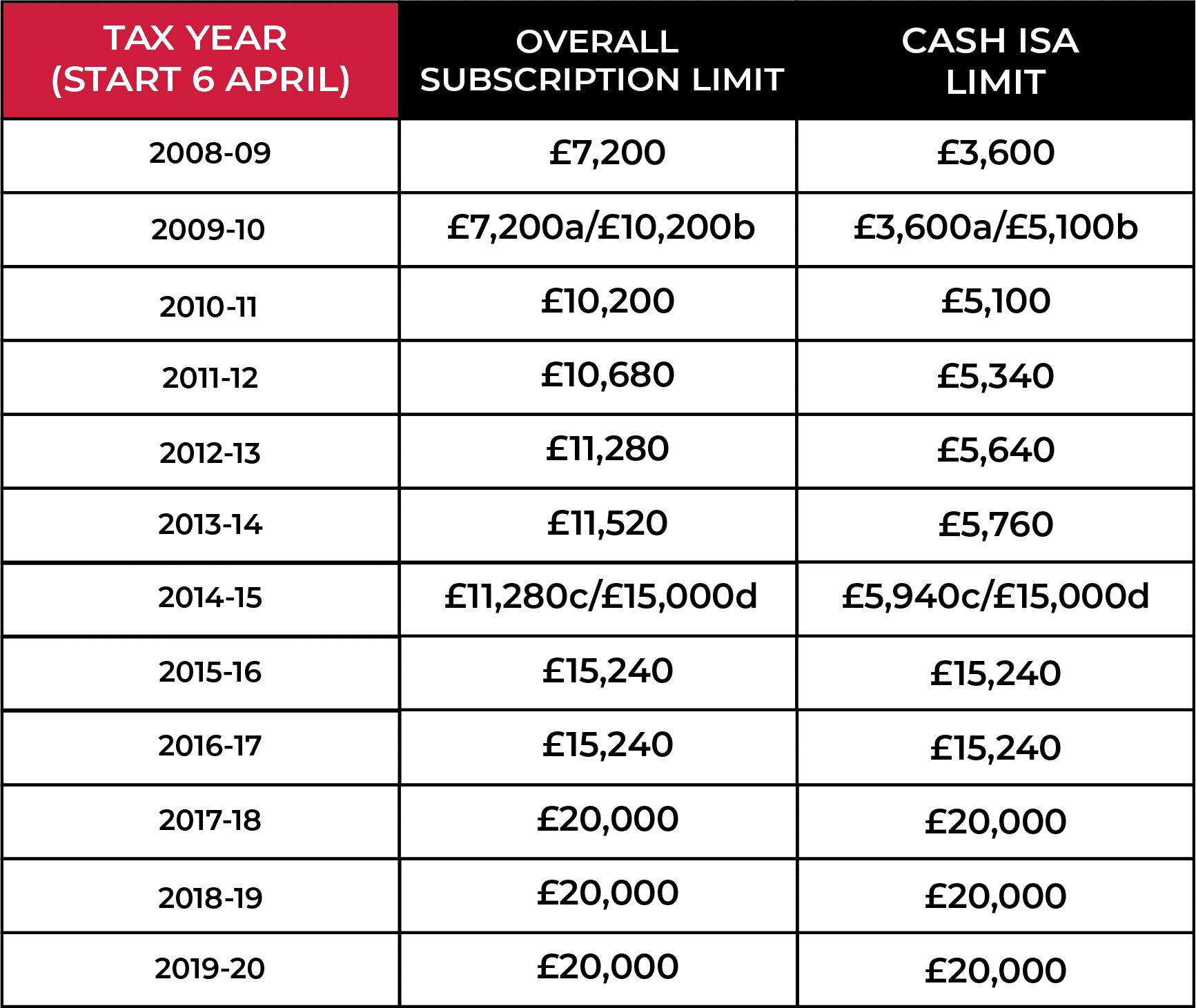

The table below presents how the tax allowance has risen over the past decade, demonstrating the consistency in expansion which could only grow.

Which ISA is best for me?

ISAs are avaliable to anyone once you turn 16 and if you wait just that little bit longer, until you’re 18, you can open a Lifetime ISA. This ISA is the ideal option for a first-time buyer, if the property your looking into buying is worth £450,000 or less. Whatever you pay in, the government pays a 25% bonus monthly, meaning you see your money grow quicker. It does however have to have been open for a year minimum before you can use it, but if you aren’t in any rush to buy a property it could be a great option.

Although you are capped to £4000 annually, ISAs aggregate so you can still pay £16,000 into any other ISAs you have. If you’ve opened the Lifetime ISA but decide not to use the money for a property, you can also use it for your pension which you will be able to access when you reach 60.

One of the only drawbacks to this ISA is if you want to withdraw the money for something other than these two things you will be charged 25% to do so. To open this ISA, you must be 18-40 and can keep paying into it until you’re 50. After this point, you will still receive interest on your savings, but no bonus will be given. If you die, the ISA terminates on the date of your death and there are no charges to withdraw the money.

But there are many types of ISAs available, so you have options and flexibility to find the right fit for your money.

“There are many types of ISAs available, so you have options and flexibility to find the right fit for your money.”

These other types of ISAs include:

Cash ISA

Like a normal savings account only the interest is tax free it comes in a few different varieties including:

Easy Access – which allows you the freedom to withdraw cash at any time.

Fixed Rate – Which guaantees you a fixed rate for a term that suits you, but withdrawing cash can be tricky.

Regular Savers Cash ISA – These are great for shorter term savings goals with the downside being the low interest rates.

Stocks and shares ISA

This type of ISA allows you to invest in stocks and shares. They usually have higher interest rates so you can grow your money quicker, however, there is also a chance of losing money as the value of your investment can fluctuate.

This ISA is great for long term saving and the money becomes an investment. A product such as this is available on i-stock, provides you with an easy, efficient way to monitor and protect your money.

Junior ISA

This is an ISA designed with your children in mind to help them start growig a nest egg of their own. Although you must be the parent/legal guardian to open the ISA, you’ll be happy to know it’s not just you who can pay into it, any relative or friend can. While the allowance for the Junior ISA is capped at £4,368, this stays separate from your own allowance of £20,000, so you can maximize their savings as well as yours. With help from our “Summer of Money” blog, you can teach your children to look after their own ISA savings, the best way.

How much can I put into my ISA?

A tax year runs from April to April, this is the time that you must use up your ISA allowance of £20,000. If you don’t use it, you lose it – so if you were hoping to add on any unspent allowance into the next tax year, you can’t. However, you do get a fresh allowance of £20,000. You can then split this amongst multiple ISAs simultaneously, however you are limited to one of each type of ISA. For example, you could be paying into a Cash ISA but could also pay into Lifetime ISA, these would all be under the capped allowance of £20,000 for the tax year.

Can you withdraw money from your ISA?

Sometimes we need that extra bit of cash now that we wanted to save for later, and that’s something your ISA understands. Other than a Lifetime ISA you can withdraw money without losing the tax benefits. With some flexible ISAs you can even pay the money back in without it being deducted from your years allowance.

With the ISA available on i-stock, you can withdraw your deposit at any time with no penalties or fees.

Can you transfer your ISA?

An ISA transfer is when you decide to move your ISA from one provider to another which you can do as often as you like.

With some ISA providers, you could find yourself locked into a minimum investment period. But with a i-stock ISA, as well as being free to run, there is no minimum period and your cash is never ‘locked’. This means you can withdraw todays money, tomorrow, keeping you safe in the knowledge that your cash is always accessible to you. Why not transfer all your ISAs into one central account as it can minimize your cost of investing. You can do this quickly and simply through i-stock, eliminating any hurdles.

The end of the tax year is coming around fast. This is prime time to use your allowance up to get ready to open a new ISA. It could be a viable option for anyone looking to save long term.

They are one of the best options for the protection and growth of your savings keeping them far outside the reach of the tax man, with any interest earned on top of the savings you have already accumulated being yours, and yours alone.

PROVIDING NEWS AND VIEWS TO SUIT ALL NEEDS

This Blog is published and provided for informational purposes only. The information in the Blog constitutes the author’s own opinions. None of the information contained in the Blog constitutes a recommendation that any particular investment strategy is suitable for any specific person.

Recent Comments